"The whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by menacing it with an endless series of hobgoblins, all of them imaginary." ~ H.L. Mencken

The Evolution of the Welfare-Warfare State

Exclusive to STR

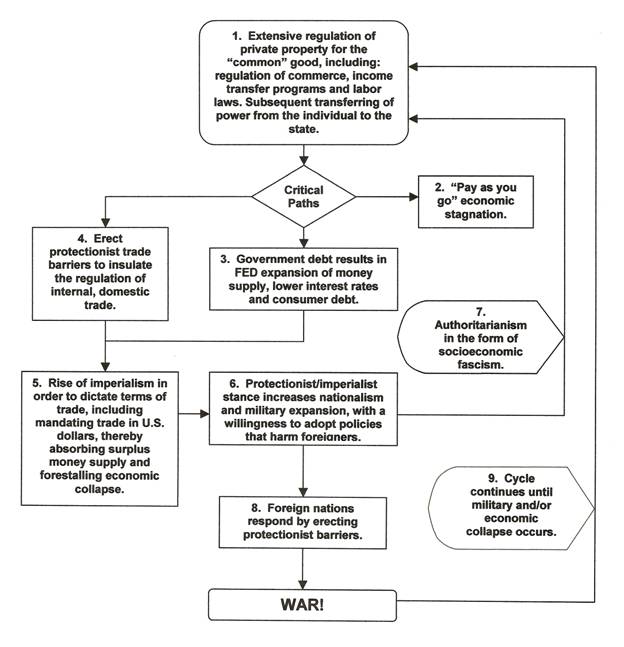

The author presents a model in the form of a flow chart that briefly attempts to depict the evolution of the welfare-warfare state with an emphasis on the American experience. There is a wealth of literature available to support the elements of this model. The author has cited a few of the sources that informed him and offer the reader a fuller treatment of the subject.

1. America 's drift into the Welfare-Warfare State has its roots in the Progressive drive for the egalitarian society, free of wealth and political power dissimilarities and underscored by a vaguely defined sense of 'social justice.' Extensive regulation of private property and commence was thought to achieve this end, along with income redistribution and laws protecting labor. Subsequently, the Federal Register is close to 80,000 pages of regulatory codes with annual compliance costs of $1,172 trillion, or $39,000 per individual. Private charities have suffered and labor laws have designated unions as government supported monopolies on the supply of labor. All of these actions have transferred significant power from the individual to the state. (*) (*) (*) (*) (*)

2. Once a nation has started the journey to the Welfare State, there are certain critical paths (policy choices) that can be followed in an attempt to reach that destination. One path is a 'pay as you go' system financed by high taxation. This has the desirable effect of limiting deficit spending but will ultimately lead to economic stagnation as more and more wealth is appropriated for government expenditures along with ever-expanding regulation. This has the effect of choking production and gradually making everyone poorer. Because America 's expenditures, however, exceed tax revenues, another critical path must be followed. (*) (*) (*)

3. A second policy path that can be chosen when the current level of taxation cannot pay for government expenditures is to engage in deficit spending. Through the selling of bonds to a central bank, the nation has an opportunity to monetize the debt, effectively increasing the money supply. Central banks, such as the Fed, can also expand credit through the lowering of interest rates, creating even more money out of thin air. Both the nation and its citizenry are then concurrently in substantial debt, a debt being serviced through the use of inflated, cheaper money. (*) (*) (*) (*) (*)

4. When a nation extensively regulates domestic commerce, including what can be produced, the production and distribution process, the raw materials of production, workplace rules, and subsidizes select products, it cannot then allow imported goods to threaten this regulatory system. Protecting this internal regulation and corporate welfare necessitates a third critical policy path: the erecting of international trade barriers and/or agreements in an attempt to force foreign nations to trade in compliance with the existing internal trade regulations. (*) (*) (*)

5. The confluence of both elements above (3 & 4) will drive a nation, such as the United States , into a militaristic imperialism designed to control the terms of trade on a worldwide scale while ensuring a flow of needed natural resources. One of America 's terms of international trade has been the use of the American dollar as the world's reserve currency. This has the effect of sponging up excess dollars being printed to finance government debt. Nations such as Iraq and Iran switched their oil trade from dollars to Euros with predictable reactions from the U.S. This has not deterred other nations from expressing concern about American expansion of the money supply ' an expansion that must continue to increase in order to monetize our $100 trillion of unfunded, long term, social welfare debt. (*) (*) (*)

6. Consistent with the observations of economist Ludwig von Mises, as the American welfare state has grown, along with its protectionist and imperialist stance, so has nationalism and military expansion. It is now part of our national belief that we are surrounded by those who wish us harm and that we must be saved by a strong, centralized government headed by a powerful, charismatic leader who manages to be seen on the mass media daily cajoling and exhorting us to support his domestic and foreign programs. Meanwhile, the United States maintains over 700 military bases overseas and has become engaged in a series of military confrontations. Not to be outdone, the Fed has significantly expanded the money stock, which is currently being held as reserves in banks while the Fed encourages these banks to lend more. When these banks do begin to lend, up to five trillion new dollars could enter the economy, further reducing the value of the dollar and economically harming those countries that hold American currency. If these countries decide to dump only half of these cheapened dollars, we could see a further expansion in the money supply by 30%. (*) (*) (*)

7. This welfare-warfare model of evolving state social policy will incrementally lead to an authoritarian socioeconomic fascism, as explored by the author in a previous column. The partnership between business, government and powerful labor unions, resulting in the corporate state, along with the strict regulation of everyday economic activity, will ultimately take its toll on individual liberty. Political power will continue to be centralized in the federal government, as the once sovereign states become mere administrative units of federal policy. (*) (*) (*) (*) (*)

8. Most readers of this daily forum will acknowledge that wars have economic causes, dressed up in fine clothing with stirring rhetoric by politicians to widen public support for the carnage. Protectionist trade policies often lead to foreign nations erecting their own trade barriers. 'When goods cannot cross borders, armies will,' Fredrick Bastiat famously remarked, highlighting the fact that trade wars often lead to shooting wars. The wild ride of the inflated dollar will harm those nations who hold our dollars and our loans. These loans will ultimately be paid back in cheap dollars, if they are paid back at all. China holds billions of dollars in U.S. Treasury bonds, yet the U.S. imposed a tariff on Chinese made tires, as if China is a helpless partner in the exchange. Imposing trade barriers and currency inflation will necessitate our ongoing military presence in the world with sporadic military interventions as our government tries to maintain the status quo ' even as the empire begins to crumble beneath our feet. (*) (*) (*)

9. Empires rise and empires fall. This is the cycle of history. As empires expand beyond their ability to finance themselves they have often relied on currency debasement and on extending their military capacity beyond popular and fiscal support. Consequently, as with the Soviet Union , economic bankruptcy and military collapse often occur suddenly and simultaneously, along with the state apparatus that supported them. One can only hope that the fall of the United States Empire will precipitate a birth of individual liberty within a minimal state. But don't hold your breath. To paraphrase Bastiat, there will always be those who attempt to grow the state in order to make a living at the expense of everyone else. (*) (*) (*).

Reprint Rights

Reprint Rights